Investing in Cryptocurrency: A Beginner’s Guide to Digital Assets

Investing in cryptocurrency involves purchasing digital assets like Bitcoin or Ethereum, with the hope that their value will increase over time, offering potentially high returns but also carrying significant risks for beginners.

Embarking on the world of investing in cryptocurrency: a beginner’s guide to digital assets can seem daunting. However, with the right knowledge and a cautious approach, you can navigate this exciting landscape and potentially grow your wealth.

Understanding Cryptocurrency: What is it?

Before diving into investing, it’s crucial to grasp the fundamentals of cryptocurrency. What exactly *is* this digital asset that’s capturing so much attention?

Cryptocurrency is essentially digital or virtual money that uses cryptography for security. Most cryptocurrencies operate on a decentralized technology called blockchain.

Blockchain Technology Explained

The blockchain is a distributed, public ledger that records all transactions. This decentralized nature makes it difficult to tamper with, adding a layer of security and transparency.

Key Features of Cryptocurrency

Understanding the core characteristics of cryptocurrency can help you make informed decisions.

- Decentralization: Not controlled by a single entity like a central bank.

- Transparency: Transactions are recorded on a public ledger.

- Security: Cryptography ensures secure transactions.

- Limited Supply (Often): Many cryptocurrencies, like Bitcoin, have a capped supply, potentially increasing scarcity.

In summary, cryptocurrency represents a digital alternative to traditional currencies, leveraging blockchain technology for enhanced security and transparency. Recognizing these underlying principles is essential for successful and informed investing.

Getting Started: Essential Steps Before Investing

Ready to take the plunge? Before you invest a single dollar, certain preparatory steps are vital for protecting yourself and your assets.

Think of this as laying a foundation for a safe and informed investment journey.

Choosing a Cryptocurrency Exchange

A cryptocurrency exchange is a platform where you can buy, sell, and trade cryptocurrencies. Selecting the right exchange is crucial.

Consider factors like:

- Security Measures: Does the exchange have robust security protocols like two-factor authentication?

- Fees: What are the transaction fees, withdrawal fees, and deposit fees?

- Supported Cryptocurrencies: Does the exchange offer the cryptocurrencies you’re interested in?

- User Interface: Is the platform easy to navigate and understand?

Setting Up a Secure Wallet

A cryptocurrency wallet is where you store your digital assets. It’s essential to choose a secure wallet.

There are different types of wallets:

- Hardware Wallets: Physical devices that store your private keys offline, providing the highest level of security.

- Software Wallets: Applications installed on your computer or smartphone.

- Exchange Wallets: Provided by the cryptocurrency exchange, convenient for trading but less secure.

Ultimately, taking these preliminary actions—choosing a reliable exchange and securing your digital assets in a safe wallet—will substantially reduce risks right from the start in the world of cryptocurrency investing.

Understanding Risk and Volatility

A clear understanding of the risks is crucial for anyone considering investing in digital currencies.

Cryptocurrency is known for its high volatility and inherent risks.

What is Volatility?

Volatility refers to the degree of price fluctuation of an asset over time. Cryptocurrency prices can swing dramatically in short periods.

Common Risks in Cryptocurrency Investing

Be aware of these common pitfalls when getting into digital currency investing:

- Market Risk: Prices can fall due to market sentiment, news events, or regulatory changes.

- Security Risks: Exchanges and wallets can be hacked, leading to loss of funds.

- Regulatory Risk: Changes in government regulations can impact the value of cryptocurrencies.

- Technology Risk: Bugs in the underlying technology can lead to vulnerabilities.

Recognizing volatility and knowing these risks equips investors with a sound perspective. Responsible participation begins with knowing what to expect, and preparing a plan to navigate the inevitable ups and downs.

Developing an Investment Strategy

A well-defined investment plan can help you navigate the turbulent world of digital assets.

Without a strategy, investing in cryptocurrency can feel like gambling.

Define Your Investment Goals

Are you looking for short-term gains or long-term growth? Your goals will influence your investment choices.

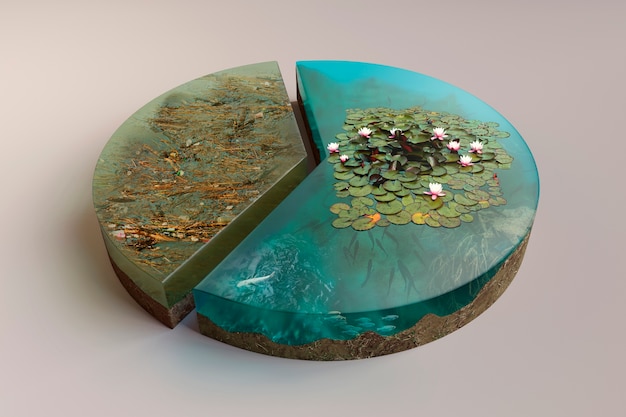

Diversify Your Portfolio

Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies to mitigate risk.

Dollar-Cost Averaging

Invest a fixed amount of money at regular intervals, regardless of the price. This can help reduce the impact of volatility.

Research and Due Diligence

Before investing in any cryptocurrency, thoroughly research its technology, team, and market potential.

By designing a plan, including clearly defining objectives, spreading your resources across various assets, using dollar-cost averaging, and conducting detailed research—you may increase your prospects of success.

Popular Cryptocurrencies for Beginners

With thousands of cryptocurrencies available, choosing the right ones to invest in can be overwhelming. Here are a few popular options for beginners.

These cryptocurrencies are generally considered more established and have larger market capitalizations.

Bitcoin (BTC)

The first and most well-known cryptocurrency, often referred to as “digital gold.”

Ethereum (ETH)

A platform for building decentralized applications (dApps) and smart contracts.

Litecoin (LTC)

Often referred to as the “silver to Bitcoin’s gold,” Litecoin offers faster transaction times.

Choosing the right cryptocurrency to back as a beginner can be simplified by starting with more established choices. Bitcoin, Ethereum, and Litecoin have stood the test of time—making them relatively safer.

Long-Term vs. Short-Term Investing

Decide which approach aligns with your financial goals and risk tolerance.

Understanding the differences between long-term and short-term strategies is essential for successful investing.

Long-Term Investing (HODLing)

Holding cryptocurrencies for extended periods (months or years) with the expectation of long-term growth. This is often referred to as “HODLing” (Hold On for Dear Life).

Short-Term Investing (Trading)

Actively buying and selling cryptocurrencies to profit from short-term price fluctuations. This requires more time, knowledge, and risk tolerance.

In conclusion, deciding between long-term (HODLing) and short-term (trading) depends mainly on your timeline. Gauge the amount of attention required to manage positions, research thoroughly, and decide the approach that best supports your wider goals.

Staying Informed and Safe

Staying up to date and maintaining security awareness can significantly enhance your cryptocurrency investing journey.

The cryptocurrency landscape is constantly evolving, so continuous learning is crucial.

Reliable Resources

Consult some sites that will keep you up to date on the current news and information:

- CoinDesk and CoinTelegraph: Popular sources for cryptocurrency news and analysis.

- Whitepapers: Official documents that explain the technology behind a cryptocurrency.

Security Best Practices

Safekeeping while navigating the investment world is vital. Here’s some advice you can use:

- Use Strong Passwords: Employ complex, unique passwords for all your accounts.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your exchange and wallet accounts.

- Be Wary of Phishing Scams: Don’t click on suspicious links or share your private keys.

Maintaining current awareness via trustworthy resources and rigorous safety practices may make the biggest difference in securing your digital investments.

| Key Point | Brief Description |

|---|---|

| 🔑 Understand Cryptocurrency | Learn the basics of digital assets and blockchain technology. |

| 🛡️ Secure Your Wallet | Choose a hardware or software wallet for secure storage. |

| ⚠️ Assess Risk | Be aware of market volatility and regulatory risks. |

| 📊 Diversify investments | Spread assets along multiple cryptocurrencies to mitigate loss. |

FAQ

A cryptocurrency exchange is a digital marketplace, or platform, where you can buy, sell, and trade different types of cryptocurrencies like Bitcoin and Ether. It acts as an intermediary between buyers and sellers of digital currencies.

The main types of crypto wallets include: hardware wallets (physical devices), software wallets (apps on your phone or computer), and exchange wallets (provided by an exchange). Hardware wallets offer the most security.

Volatility refers to the rate at which the price of an asset increases or decreases over a specific period. Higher volatility in crypto means prices can change rapidly and significantly, leading to an increased risk.

Diversification is a strategy of spreading investments along multiple avenues, so that if one cryptocurrency fails, the entire portfolio is not affected significantly. It minimizes risks and balances potential for success.

To stay updated on crypto investments, consulting reputable sources such as CoinDesk, CoinTelegraph, and the official whitepapers of different cryptocurrencies is vital to ensure the news is factual. These can better inform decisions.

Conclusion

Investing in cryptocurrency can be a rewarding, albeit risky, endeavor. By understanding the fundamentals, taking precautions, developing a solid strategy, and staying informed, you can navigate the cryptocurrency market with greater confidence and potentially achieve your financial goals.